Exploring Advanced Functions of Modern 2D Payment Gateways for Boosted Customer Experience

Exploring Advanced Functions of Modern 2D Payment Gateways for Boosted Customer Experience

Blog Article

The Duty of a Settlement Portal in Streamlining E-Commerce Repayments and Enhancing Customer Experience

The integration of a repayment entrance is crucial in the shopping landscape, working as a protected channel between customers and vendors. By allowing real-time deal processing and supporting a variety of payment methods, these portals not just minimize cart desertion yet additionally boost total consumer complete satisfaction. Their emphasis on safety and openness grows count on in a progressively affordable marketplace. As we check out the multifaceted benefits of settlement entrances, it becomes vital to check out just how these systems can additionally develop to fulfill the needs of both companies and customers alike.

Recognizing Payment Portals

A payment portal acts as a crucial intermediary in the ecommerce purchase process, facilitating the safe transfer of payment info in between customers and sellers. 2D Payment Gateway. It makes it possible for on the internet organizations to accept different kinds of repayment, consisting of credit cards, debit cards, and digital budgets, thus broadening their client base. The portal runs by encrypting sensitive info, such as card details, to guarantee that information is sent securely online, minimizing the threat of fraudulence and information breaches

When a customer initiates a purchase, the repayment portal records and forwards the purchase information to the suitable monetary organizations for consent. This procedure is generally seamless and happens within secs, supplying consumers with a liquid shopping experience. Additionally, settlement portals play a crucial role in conformity with sector requirements, such as PCI DSS (Repayment Card Sector Data Safety Criterion), which mandates rigorous security procedures for processing card settlements.

Recognizing the technicians of repayment gateways is important for both customers and merchants, as it straight influences deal effectiveness and customer trust. By making certain safe and effective deals, repayment portals add considerably to the overall success of shopping companies in today's electronic landscape.

Secret Attributes of Repayment Gateways

A number of key attributes define the performance of repayment gateways in ecommerce, making sure both safety and security and benefit for customers. One of one of the most important features is durable safety procedures, including file encryption and tokenization, which safeguard sensitive customer data throughout transactions. This is vital in fostering depend on in between sellers and consumers.

Furthermore, real-time transaction handling is important for guaranteeing that payments are finished quickly, reducing cart desertion rates. Settlement portals likewise offer fraudulence detection devices, which keep an eye on deals for suspicious task, further safeguarding both consumers and merchants.

Advantages for Ecommerce Companies

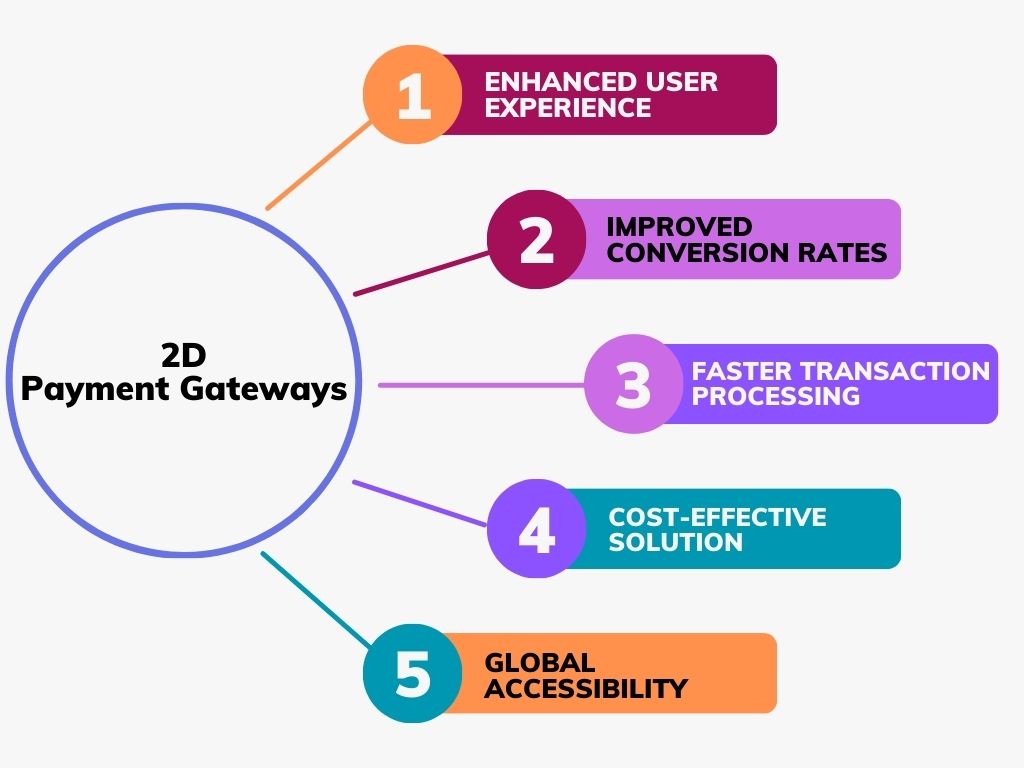

Various advantages emerge from incorporating repayment gateways right into ecommerce services, dramatically boosting functional effectiveness and customer satisfaction. Repayment portals promote seamless deals by firmly processing settlements in real-time. This ability minimizes the probability of cart desertion, as customers can promptly finish their purchases without unnecessary hold-ups.

Moreover, settlement gateways sustain several repayment approaches, accommodating a diverse series of client choices. This adaptability not only draws in a wider consumer base yet also fosters loyalty among existing clients, as they feel valued when used their recommended settlement options.

Additionally, the assimilation of a settlement entrance typically results in enhanced protection functions, such as encryption and fraud discovery. These procedures shield delicate consumer information, consequently building count on and reputation for the shopping brand name.

Moreover, automating payment procedures through entrances reduces hand-operated workload for staff, permitting them to focus on strategic campaigns rather than regular tasks. This functional efficiency translates right into price savings and boosted resource allocation.

Enhancing Customer Experience

Integrating a reliable payment portal is important for enhancing individual experience in e-commerce. A smooth and effective repayment process not only constructs consumer count on yet also lessens cart desertion rates. By supplying multiple repayment alternatives, such as bank card, digital pocketbooks, and financial institution transfers, companies provide to varied customer choices, thereby enhancing contentment.

Furthermore, a straightforward user interface is vital. Payment gateways that supply intuitive navigating and clear guidelines enable customers to total purchases quickly and effortlessly. hop over to these guys This simplicity of usage is essential, especially for mobile customers, that call for maximized experiences customized to smaller sized displays.

Safety and security features play a significant role in individual experience. Advanced security and fraudulence discovery devices comfort consumers that their sensitive data is safeguarded, promoting self-confidence in the purchase procedure. Furthermore, clear communication concerning plans and costs boosts reliability and decreases prospective irritations.

Future Trends in Settlement Handling

As ecommerce remains to progress, so do the fads and innovations shaping settlement processing (2D Payment Gateway). The future of payment handling is marked by several transformative fads that guarantee to enhance efficiency and customer fulfillment. One considerable trend is the surge of expert system (AI) and artificial intelligence, which are being progressively integrated into payment portals to boost safety with innovative fraud detection and threat analysis

Additionally, the adoption of cryptocurrencies is gaining grip, with even more organizations discovering blockchain technology as a viable alternative to traditional settlement techniques. This change not only supplies reduced deal fees yet additionally attract an expanding group that values decentralization and personal privacy.

Mobile budgets and contactless repayments are becoming mainstream, driven by the need for faster, easier transaction approaches. This trend is more fueled by the boosting frequency of NFC-enabled devices, enabling seamless purchases with simply a tap.

Lastly, the focus on governing conformity and information protection will shape payment processing methods, as services make every effort to build count on with consumers while adhering to progressing lawful structures. These fads collectively indicate a future where payment processing is not only faster and a lot more secure but likewise more lined up with customer expectations.

Final Thought

Finally, payment entrances work as essential visit this page elements in the e-commerce ecological community, facilitating safe and efficient purchase processing. By providing diverse repayment choices and prioritizing individual experience, these entrances dramatically decrease cart abandonment and improve customer contentment. The ongoing development of repayment modern technologies and security steps will additionally reinforce their duty, guaranteeing that ecommerce organizations can fulfill the needs of increasingly sophisticated consumers while fostering count on and credibility in online transactions.

By enabling real-time see this website transaction processing and supporting a range of repayment techniques, these entrances not only reduce cart abandonment however likewise improve general client fulfillment.A repayment portal offers as a crucial intermediary in the e-commerce transaction process, helping with the protected transfer of payment information between clients and sellers. Payment entrances play a pivotal duty in compliance with market criteria, such as PCI DSS (Settlement Card Industry Data Safety Criterion), which mandates rigorous protection measures for refining card settlements.

A flexible repayment entrance accommodates credit score and debit cards, digital purses, and alternative settlement techniques, catering to varied client choices - 2D Payment Gateway. Repayment gateways facilitate smooth deals by securely refining repayments in real-time

Report this page